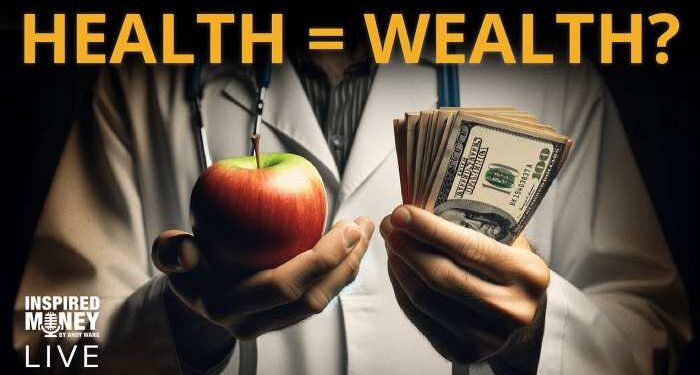

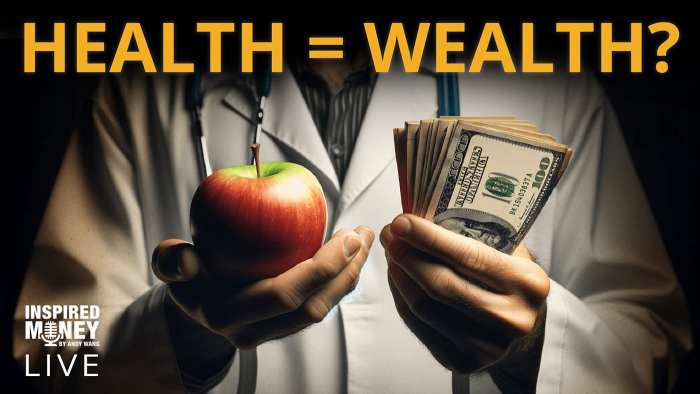

Merging Wellness and Wealth: The Future of Lifestyle sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Exploring the merging of wellness and wealth opens up a world of possibilities where lifestyle choices intersect with financial and health aspects, shaping individuals' overall well-being.

Understanding the Concept

When we talk about merging wellness and wealth, we refer to the holistic approach of integrating financial well-being with physical and mental health. It's about recognizing that one's overall well-being is influenced by both their financial status and their health.

Significance of Integrating Lifestyle with Financial and Health Aspects

Integrating lifestyle with financial and health aspects is crucial for maintaining a balanced and fulfilling life. By considering how our financial decisions impact our health and vice versa, we can make more informed choices that contribute to our overall well-being.

Connection Between Wellness and Wealth Affecting Overall Well-being

The connection between wellness and wealth plays a significant role in determining an individual's overall well-being. Financial stability can reduce stress and anxiety, leading to better mental health. Similarly, investing in one's health can result in increased productivity and longevity, ultimately contributing to a higher quality of life.

Lifestyle Design

Creating a lifestyle that promotes both wellness and wealth is essential for overall success and satisfaction. Lifestyle choices can have a significant impact on both health and financial status, influencing our well-being and long-term prosperity.

Examples of Lifestyle Choices Impacting Health and Financial Status

- Prioritizing regular exercise and a balanced diet can lead to better health outcomes, reducing medical expenses and improving overall quality of life.

- Choosing to invest in personal development and education can increase earning potential and career advancement opportunities.

- Adopting frugal habits such as budgeting and saving can help accumulate wealth over time and provide financial security.

- Engaging in stress-reducing activities like mindfulness meditation can improve mental health and productivity, leading to better financial decision-making.

Strategies for Creating a Balanced Lifestyle

It's important to find a balance between prioritizing wellness and wealth in your lifestyle. Here are some strategies to help you achieve this balance:

- Set clear health and financial goals to guide your decision-making and priorities.

- Create a daily routine that includes time for exercise, healthy meals, work, relaxation, and personal development.

- Allocate your resources wisely, investing in experiences and products that contribute to your well-being and long-term financial stability.

- Practice mindful spending and saving, being intentional about your financial choices and avoiding unnecessary expenses.

Tips for Aligning Lifestyle with Financial and Health Goals

- Track your progress towards your goals regularly, adjusting your lifestyle choices as needed to stay on track.

- Seek support from professionals such as financial advisors, personal trainers, or wellness coaches to help you achieve your goals effectively.

- Cultivate a positive mindset and resilience to overcome challenges and setbacks on your journey towards a balanced lifestyle.

Financial Wellness

Financial wellness is a crucial component of overall well-being, encompassing the ability to manage financial resources effectively to meet current needs while planning for the future. It involves understanding one's financial situation, making informed decisions, and taking actions to secure financial stability.

Key Factors Contributing to Financial Wellness

- Income Management: Maintaining a balance between income and expenses is essential for financial wellness. Budgeting and tracking expenses can help individuals live within their means and avoid debt.

- Debt Management: Managing and reducing debt levels play a significant role in achieving financial wellness. Strategies such as debt repayment plans and consolidation can help individuals regain control of their finances.

- Emergency Savings: Building an emergency fund to cover unexpected expenses or financial setbacks is crucial for financial wellness. Having a safety net can provide peace of mind and prevent the need to rely on high-interest debt.

- Financial Literacy: Understanding basic financial concepts and practices is essential for making informed decisions. Financial education can empower individuals to navigate complex financial systems and make sound choices.

Role of Savings, Investments, and Financial Planning

- Savings: Regularly saving a portion of income can help individuals build wealth over time and achieve financial goals. Setting specific savings targets and automating contributions can facilitate the savings process.

- Investments: Investing in assets such as stocks, bonds, and real estate can generate returns and grow wealth. Diversifying investments and aligning them with financial goals are key strategies for financial wellness.

- Financial Planning: Developing a comprehensive financial plan that includes goals, budgeting, savings, investments, retirement planning, and risk management is essential for achieving long-term financial wellness. Seeking guidance from financial advisors can help individuals create a customized plan tailored to their needs.

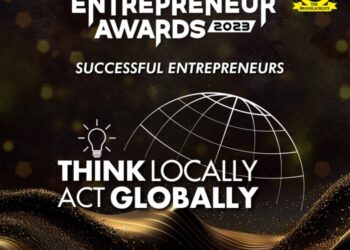

Wellness Investment

Investing in wellness activities goes beyond just improving one's health; it can also have significant long-term financial benefits. By prioritizing wellness and making investments in activities that promote overall well-being, individuals can not only enjoy a better quality of life but also potentially see financial gains in the future.

Examples of Wellness Investments

- Regular exercise routines can reduce healthcare costs in the long run by preventing chronic diseases and reducing the risk of medical emergencies.

- Healthy eating habits can lead to increased productivity and energy levels, which can translate to higher income potential in the workplace.

- Investing in mental health practices such as meditation or therapy can improve cognitive function and decision-making abilities, potentially leading to better financial outcomes.

Importance of Prioritizing Wellness as an Investment

Wellness should be viewed as a crucial investment in one's future, as it not only impacts physical health but also mental well-being and financial stability. By allocating resources towards wellness activities, individuals can proactively manage their health and potentially avoid costly medical expenses down the line.

Ultimate Conclusion

In conclusion, the blend of wellness and wealth in lifestyle design presents a unique path towards a fulfilling and prosperous future, emphasizing the importance of balancing financial goals with health priorities for a holistic approach to well-being.

Popular Questions

What does merging wellness and wealth entail?

Merging wellness and wealth involves integrating lifestyle choices that prioritize both financial stability and health well-being.

How can individuals align their lifestyle with financial and health goals?

Individuals can align their lifestyle with financial and health goals by creating a balanced approach that focuses on both wellness and wealth management.

Why is it important to invest in wellness activities for long-term benefits?

Investing in wellness activities for long-term benefits is crucial as it not only enhances health but can also lead to financial gains in the future.